Recent Posts

- Lottery Payout Options: What’s the Best Choice for You?

- Short-Term Visa for Germany: Exploring the Country on a Temporary Basis

- Steroids and Autoimmune Diseases: The Immunomodulatory Properties of Performance-Enhancing Drugs

- Where Can I Purchase Elvanse 70 mg Without a Prescription?

- Skyline Shapers: The Innovative Journey of Vital Developers Limited

Recent Comments

Giga spin8 SLOT777 depo pulsa 5k TIMNAS4D royal77 autospin777 lentor mansion floor plan bola16 MPOPUSATLOGIN MENARA4D Local Viking range repair koitoto MENARA 4D rupiahtoto Bola16 Slot Gacor toto spin login pgsoft 10rb Bandar togel PAP4D padangtoto ingatbola88 Pussy888 Download rungkad bandar togel mahjong118 zeus slot slot zeus zeus slot Sabung Ayam Online liveslot365 liveslot365 mahjong ways 2 https://dewansengketa.id/wp-content/upgrade/app/config/ akun pro thailand اسم سایت های شرط بندی

สล็อตเว็บตรง

bagnall haus price MOLE4D KENANGAN4D SV388 MPO Slot sv388 autospin777 rtp live tradisibet the arcady at boon keng showflat MEGA888 bio88 slot situs mpo slot Servertogel Servertogel Slot Thailand slot thailand onic77 login slot thailand MOLE4D KENANGAN4D padangtoto BBNI4D rupiahtoto Jeparatoto padangtoto https://ekobintang.com/ totobet 22 BBTN4D hotel4d musik4d Topcer88 Topcer88 kenangan4d Cactus Labs iramatogel login PEWE4D BBNI4D Link Kingcobratoto Mailhosting slot online KKSLOT777 login dana69 Dana69 Angkanet slot Axa Claims Number sakura slot slot88 server thailand Kera4d slot gacor Auto Lautsprecher Systeme Slot link slot thailand livetotobet slot gacor hari ini bandungtoto slot server https://espacioiaunesco.org/ slot88 resmi Raja Slot link slot gacor situs online gacor GTA138 situs toto real estate franchise weichert Sultan88 Betwin188 slot88 deposit pulsa indosat 10rb pohon4d Crypto Trade Mastermind slot88 deposit pulsa tri 10rb slot gacor online nexus slot online

master togel car insurance online situs togel pokkawin situs togel bet 100 ug808 agen togel situs togel togelup bo togel slot gacor 88 kebaya4d situs togel Slot server Thailand Duta168 Slot Online Slot gacor https://www.infoselebriti.top https://www.selebterkini.live/ Doubledown Forum Yuk69 Koitoto168 slot dana topjitu login Server Thailand winslot slot gacor slot gacor Grinding Gear games blaze entrar

online cricket betting site slot gacor hari ini marketing1on1 pohon4d

เว็บสล็อตใหม่ล่าสุด keputusan GD Slot Gacor Hari Ini djarumtoto slot taktik88

weight loss steroids for sale 3milyartoto Djarumtoto slot demo pg http://www.tint21.com 3a娛樂城 haka4d mugiwaraslot

Slot Thailand 777

slot gacor hari ini

Slot Online

UGFREAK gta online

slot gacor

Slot Gacor

Djarumtoto slot gacor situs slot gacor Login Indobet

Superdrol for sale weight loss steroids for sale uk presidenttoto

situs slot

สล็อต

เว็บตรง

สล็อต

หวย

สล็อต

SLOT GACOR 4D

link slot gacor/ sultantoto situs slot thatslikewhoa jadwal slot toto slot INFINI88 mastertoto

situs toto slot

situs toto

INFINI88

สล็อต

สล็อต

娛樂城 SBOBET88 rtp slot88 judi bola slot nexus engine WIN88 SLOT88 ULTI234 situs slot terpercaya Slot Gacor slot gacor minimal deposit 5rb apidewa

สล็อต pg เว็บตรง แตกหนัก

เว็บสล็อต slot gacor judi slot 3milyartoto

線上真人娛樂

สล็อตเว็บตรงฝาก-ถอน true wallet ไม่มีขั้นต่ํา slot888 vip cambodia Daftar Indobet lapak303 situs judi sabung ayam online sv388

娛樂城推薦

สมัครสมาชิก สล็อตเว็บตรง

เว็บตรงสล็อต papuatoto สล็อต

娛樂城推薦

เว็บตรง

dewapoker poker88 https://pohon4d.site/ dewapoker poker88 slot pragmatic

Agentoto

slot gacor gratis maxwin88 zeus138 Rajacuan Gacor77

toto88

manadototo Slot depo gopay Data macau laris99

indobetpoker

Data macau

demo slot pragmatic

koin55

Data macau

togel online

auto7slot slot thailand daftar auto7slot agen sbobet judi online

Slot88 Terpercaya

sarana99 online138 Metrowin88 Kostenloser Porno

Slot Online Slot bonus new member https://decalstor.com/

merahtoto

talent management slot https://zerotrollerance.guru/ Demo slot metrowin88 Live Draw California sexy lingerie 訂花 slot online game slot online situs slot terbaru Situs slot gacor hari ini Slot Taiwan Slot Shopeepay BENTO 4D roulette casino slot gacor hari ini del-immune birutoto tungsten wedding bands rajacuan slot 먹튀폴리스 Freebet สล็อต rtp slot slot demo demo pg soft AKUN DEMO SLOT flavorz disposables buy targeted traffic https://mtpolizia.com/ 사나이 회원가입 https://dewatogel88.life/ matka slot88 Shibatoto Daman Games daman games Slot Demo unblocked games world カラコン Daman games login HealthPlanTotal slot online ZLD SYSTEM MANUFACTURER jdclub9.co/sg/en/evo888

777slot

slot777

slot gacor malam ini

slot pragmatic play

Cryptocurrency Systems and Software Optimum Blinds

Slot Online

http://nheri.re.kr/ jasa aspal murah LumBuy

Spinning Tales: The Fascinating History of Slot Machines

Slot machines, also called one-armed bandits, have changed from simple physical products with three rotating reels to sophisticated electronic platforms giving numerous themes, functions, and earning possibilities. These activities of opportunity have grown to be renowned on the planet of casinos, both land-based and on the web, fascinating participants with their sporting lights, participating sound effects, and the allure of potential jackpots. Understanding the technicians, psychology, and techniques behind slot models is needed for enthusiasts seeking a satisfying and probably profitable gambling experience.

At the primary of each slot machine is the concept of rotating reels with numerous symbols. Modern slots frequently feature five reels, each adorned with various representations, including common photos like fruits, fortunate sevens, and bars, along with thematic symbols corresponding to the slot’s theme. The arrangement of those designs across predefined paylines determines the results of every rotate, with certain mixtures resulting in wins.

Among the critical attractions of slot products may be the selection of themes they offer. From old civilizations to outer space ventures, slots cover a great selection of topics, catering to people with different interests. Whether it’s discovering the depths of the sea or embarking on a legendary quest, the thematic selection in slots enhances the overall activity price and keeps participants engaged.

While slots are fundamentally games of opportunity, strategic components come right into perform, especially in controlling one’s bankroll and understanding the idea of volatility. Volatility, or variance, identifies the chance and reward factor associated with a unique slot. Reduced volatility slots present repeated but smaller victories, making them ideal for lengthier periods, while large volatility slots function less frequent but potentially greater payouts, attracting participants seeking huge wins.

The advent of online casinos has expanded the availability of slots, allowing participants to take pleasure from their favorite activities from the comfort of these homes. On the web slots retain the visual and auditory attraction of the land-based counterparts while presenting additional features such as for example bonus units, free spins, and gradual jackpots. The convenience and mobility offered by on line slots lead with their acceptance among a diverse array of players.

Gradual jackpots symbolize one of the most enticing areas of slot gaming. These jackpots collect across a network of interconnected models, growing with each wager until a lucky participant visits the winning combination. The allure of life-changing sums has made gradual jackpot slots a well liked among thrill-seekers, with stories of colossal benefits making a feeling of excitement and possibility.

Responsible gaming is an essential part of experiencing slots or any form of gambling. Placing restricts, both with regards to time and income, guarantees that the activity price of position play remains unchanged while mitigating the risks connected with exorbitant betflik . On the web platforms usually offer methods for participants to set deposit restricts, cooling-off times, or self-exclusion, marketing a safer gambling environment.

To conclude, slots have transcended their physical origins to become a energetic and multifaceted type of entertainment. The mixture of styles, characteristics, and the possibility of substantial payouts makes slot models a charming choice for informal participants and critical fans alike. Whether experienced in a vibrant casino or from the comfort of one’s home through online programs, the charm of slots lies not merely in the prospect of earning but also in the immersive and varied gambling experiences they offer.…

Future-Ready Commerce: The Role of Sellers in Credit Card Processing Evolution

Selling credit card processing requires navigating the elaborate earth of financial technology, knowledge the requirements of corporations, and effortlessly advertising the benefits of adopting electronic cost solutions. In today’s fast-paced and digital-centric commerce landscape, bank card handling has become an essential tool for organizations of most sizes. As an owner, it is crucial to state not merely the features of charge card handling systems but in addition the transformative impact they are able to have on a company’s efficiency, customer experience, and base line.

Among the primary elements to stress when offering charge card running may be the streamlined performance it provides to transactions. Bank card processing expedites payment cycles, decreases the risk associated with managing income, and promotes the entire speed of transactions. That effectiveness is especially valuable for firms trying to improve their operations and give a seamless knowledge for clients at the purpose of sale.

Safety is just a paramount issue in financial transactions, and bank card running offers sophisticated measures to guard painful and sensitive information. Emphasizing the effective protection top features of bank card running programs, such as for example security and submission with market requirements, reassures organizations and customers equally that their economic information is protected. This confidence is a important factor in convincing firms to really make the transition from traditional payment methods.

Still another important selling point is the flexibility of credit card handling systems to the growing wants of businesses. Whether a company operates in a brick-and-mortar setting, engages in e-commerce, or utilizes a variety of equally, credit card processing alternatives can be designed to generally meet particular requirements. This adaptability jobs credit card handling as a versatile and future-proof expense for firms expecting development and improvements within their functional models.

As a vendor, knowledge the cost-effectiveness of bank card handling is essential in making a convincing case to possible clients. While there may be preliminary setup prices, companies stay to benefit from decreased handling of bodily income, reduced individual errors in exchange saving, and improved effectiveness in control higher exchange volumes. The long-term savings and functional benefits can outweigh the original expense, making credit card processing an economically sound choice.

Featuring the customer knowledge is still another persuasive direction in offering charge card processing. In an era where customers price convenience and rapid transactions, bank card control programs donate to a positive client experience. Functions like contactless obligations and electronic wallets align with the preferences of modern people, creating organizations more appealing and aggressive in the eyes of these clientele.

As technology advances, therefore do the functions of credit card handling systems. Retailers require to stay educated about the newest inventions, such as cellular funds and integration with emerging technologies like blockchain. Demonstrating an knowledge of these improvements roles sellers as knowledgeable partners, ensuring that corporations remain prior to the bend and follow solutions that arrange with the evolving landscape of financial technology.

Making strong associations with customers is important to successful charge card handling sales. Vendors should take a consultative strategy, understanding the unique needs and suffering items of each business. By providing designed alternatives and providing continuing help, selling payment processing become trusted advisors, fostering long-term unions that increase beyond the original sale.

In summary, selling credit card processing involves not only showing something but designing a story around how it can positively influence a business. From performance and safety to flexibility and customer experience, the multifaceted advantages of bank card processing make it a transformative tool for corporations seeking to thrive in the digital age. Effective vendors understand these selling details adeptly, placing charge card handling being an crucial and strategic investment for firms seeking to remain aggressive and future-ready.…

Revolutionize Sales: The Impact of Credit Card Processing Solutions

Offering bank card processing requires navigating the complicated world of financial technology, knowledge the wants of organizations, and successfully promoting the benefits of adopting electric cost solutions. In today’s fast-paced and digital-centric commerce landscape, credit card processing is now an fundamental software for companies of all sizes. As a vendor, it is vital to articulate not only the features of credit card control programs but in addition the major influence they can have on a company’s effectiveness, client knowledge, and base line.

One of the major features to highlight when selling credit card processing could be the streamlined performance it delivers to transactions. Charge card control expedites cost cycles, decreases the risk related to handling cash, and promotes the overall speed of transactions. That performance is particularly important for corporations trying to enhance their operations and provide an easy knowledge for customers at the purpose of sale.

Safety is really a paramount matter in financial transactions, and charge card processing offers sophisticated procedures to shield sensitive and painful information. Focusing the effective security top features of charge card running methods, such as for example security and compliance with industry standards, reassures corporations and clients likewise that their economic information is protected. This trust is a critical element in effective companies to make the move from old-fashioned cost methods.

Yet another critical feature may be the flexibility of credit card running systems to the developing wants of businesses. Whether a business works in a brick-and-mortar placing, engages in e-commerce, or employs a combination of both, bank card control answers could be tailored to meet up unique requirements. This adaptability positions bank card processing as a flexible and future-proof investment for businesses expecting growth and improvements inside their detailed models.

As a seller, understanding the cost-effectiveness of charge card processing is crucial in making a engaging event to potential clients. While there could be initial startup prices, companies stand to take advantage of paid off handling of bodily cash, reduced individual problems in exchange taking, and increased performance in running larger transaction volumes. The long-term savings and operational advantages may outnumber the first expense, creating charge card control an cheaply noise choice.

Displaying the customer knowledge is still another persuasive perspective in offering charge card processing. In a time where customers price convenience and quick transactions, charge card control programs subscribe to a confident customer experience. Features like contactless payments and digital wallets align with the choices of contemporary consumers, creating organizations more inviting and competitive in the eyes of these clientele.

As engineering innovations, therefore do the functions of charge card running systems. Retailers need to remain informed about the most recent innovations, such as for example portable funds and integration with emerging technologies like blockchain. Demonstrating an understanding of these developments positions dealers as knowledgeable companions, ensuring that businesses stay prior to the contour and undertake options that arrange with the growing landscape of economic technology.

Making powerful associations with clients is integral to effective credit card processing sales. Suppliers should take a consultative method, knowledge the initial needs and pain points of every business. By giving tailored solutions and providing ongoing help, sellers become selling credit card processing advisors, fostering long-term unions that expand beyond the first sale.

In conclusion, selling charge card handling requires not just presenting something but making a narrative about how it could positively affect a business. From performance and safety to adaptability and customer knowledge, the multifaceted great things about bank card control allow it to be a transformative software for companies seeking to succeed in the electronic age. Effective vendors understand these selling factors adeptly, positioning credit card control being an necessary and strategic investment for corporations looking to remain competitive and future-ready.…

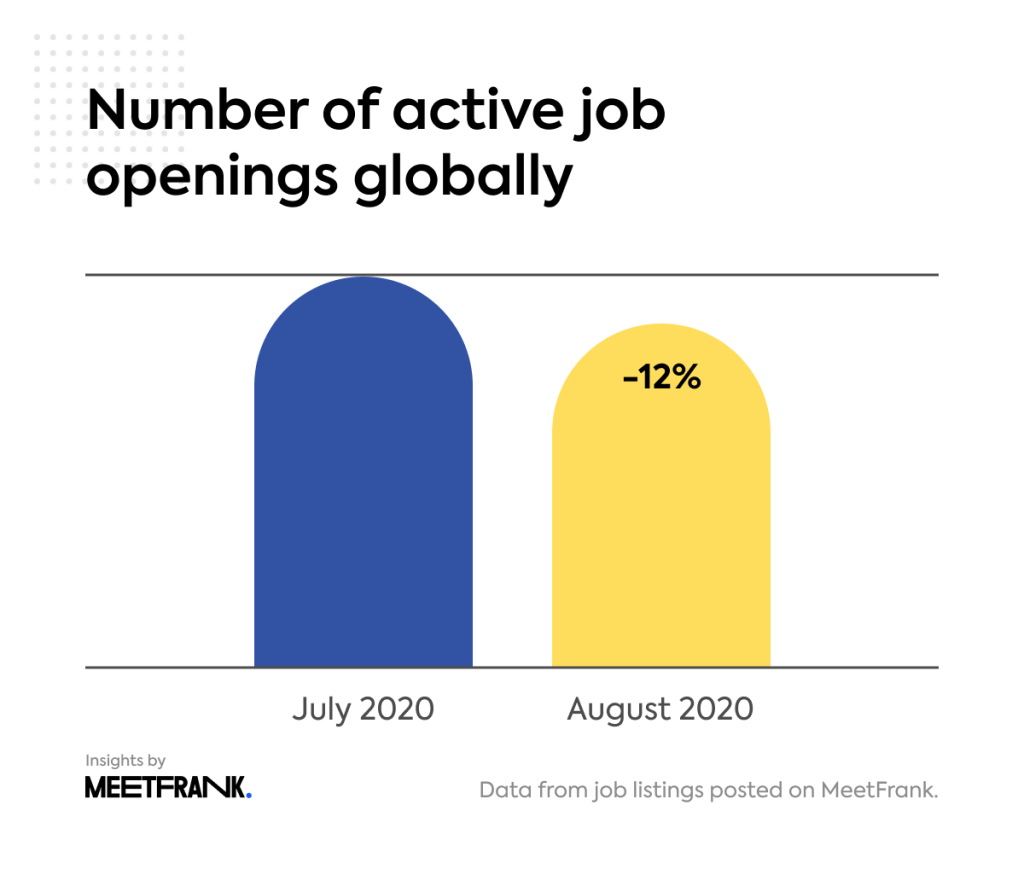

Decoding Opportunities: Job Market Insights for Graduates

Work market ideas offer as an invaluable compass for equally work seekers and employers, offering a breathtaking see of the ever-evolving employment landscape. These insights encompass a variety of facets, from emerging styles and industry requirements to the moving character of distant work and the influence of technological breakthroughs on numerous professions. Work industry insights perform a essential role in empowering people with the information required to produce knowledgeable career decisions and helping employers in moving the difficulties of talent exchange in a aggressive environment.

Knowledge recent job industry tendencies is needed for job seekers trying to arrange their abilities and aspirations with market demands. This understanding allows them to tailor their skilled development attempts and place themselves as useful resources in high-demand sectors. Moreover, staying abreast of emerging work market developments permits people to anticipate changes inside their particular areas, fostering versatility and resilience in the facial skin of changing office dynamics.

For employers, work market insights are essential instruments for ability exchange and workforce planning. These ideas offer a comprehensive comprehension of the abilities in need, enabling organizations to improve their recruiting methods and entice individuals with the knowledge required for recent and potential challenges. Employers also can use work market knowledge to standard their settlement and advantages deals, ensuring they stay competitive in attracting top-tier talent.

Remote perform has become a substantial facet of work industry ideas, specially in the wake of international changes influenced by the COVID-19 pandemic. Understanding the preferences and objectives of the workforce regarding remote work options is a must for both employers and employees. Work industry ideas shed light on the prevalence of remote perform, its effect on production, and the growing objectives for hybrid perform designs, giving a holistic view of the current workplace.

The effect of engineering on the task industry is a main design in modern work industry insights. Automation, artificial intelligence, and digitization are reshaping work demands and ability models across numerous industries. Work seekers can control this understanding to upskill in areas that arrange with technological breakthroughs, ensuring they remain competitive in a tech-driven job market. Employers, on another give, take advantage of insights in to the forms of technological skills which can be becoming significantly important across diverse sectors.

The geographic distribution of work possibilities is yet another critical facet of work market insights. Knowledge local job developments and the attention of industries in particular areas allows work seekers to target their queries strategically. It also helps employers to recognize skill pools in regions wherever their industries prosper, facilitating targeted hiring initiatives and contributing to local financial development.

Incorporating range, equity, and inclusion (DEI) criteria in to work industry insights has acquired prominence in new years. Equally job seekers and employers are increasingly valuing workplaces that prioritize diversity. Job industry ideas provide awareness in to the efforts and commitments of organizations in fostering inclusive workplaces, empowering work Global Labor Trends to arrange their values with potential employers and enabling organizations to benchmark their DEI initiatives against market standards.

As the work industry continues to evolve, job market ideas become fundamental for workforce planning and career development. Usage of appropriate and applicable information allows experts to create proper conclusions, fostering a symbiotic connection between work seekers and employers. By embracing and applying these insights, persons and agencies may navigate the complicated landscape of employment with higher speed and foresight, ultimately adding to the continuing success and resilience of the workforce ecosystem.…

Cryptocurrency Integration: Exploring the Future of Credit Card Payment Processing

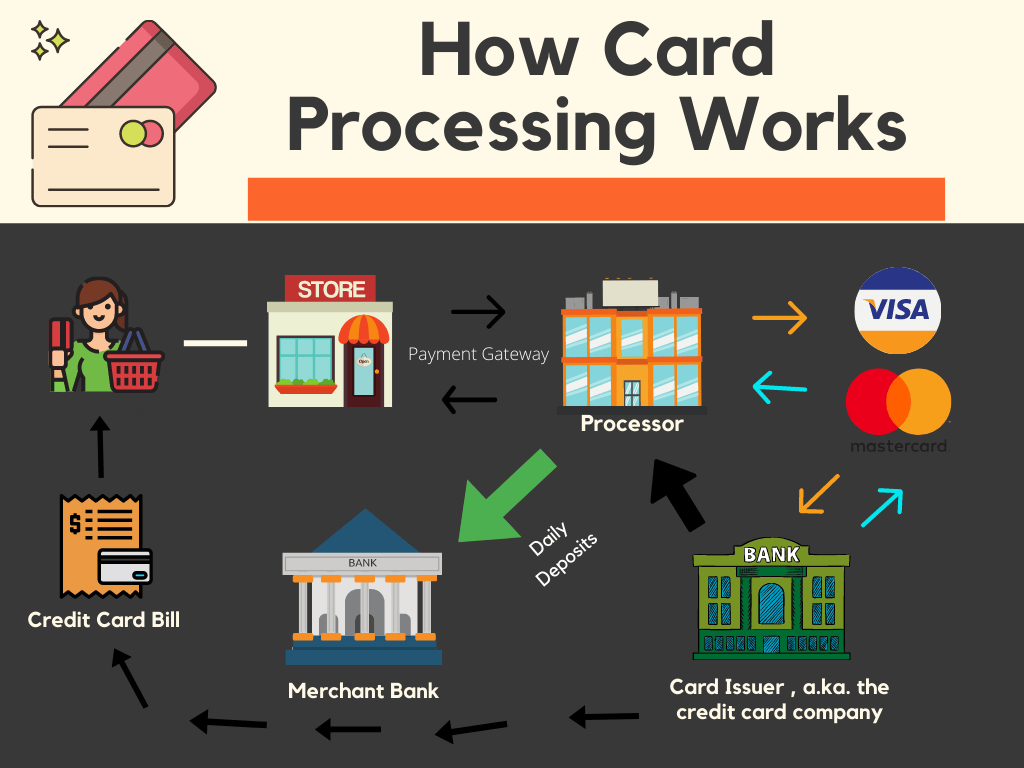

A charge card cost model plays a vital position in the modern financial landscape, providing while the linchpin that facilitates electric transactions between vendors and customers. These processors become intermediaries, joining organizations with the banking system and allowing the smooth transfer of funds. The essence of the function lies in translating the data from a bank card transaction right into a language clear by economic institutions, ensuring that obligations are approved, prepared, and settled efficiently.

One of the primary functions of a bank card cost model would be to boost the efficiency of transactions. Each time a client swipes, positions, or sinks their credit card, the cost processor quickly assesses the transaction facts, communicates with the relevant financial institutions, and validates whether the purchase may proceed. This method occurs in a subject of seconds, focusing the speed and real-time nature of credit card cost processing.

Security is a paramount issue in the region of financial transactions, and charge card cost processors have reached the forefront of applying actions to guard painful and sensitive information. Sophisticated encryption technologies and compliance with industry criteria make certain that customer knowledge stays protected through the entire payment process. These security steps not only safeguard people but also instill trust in firms adopting electronic payment methods.

The bank card cost running environment is continually developing, with processors adapting to technological breakthroughs and changing customer preferences. Portable funds, contactless transactions, and the integration of digital wallets symbolize the lead of advancement in that domain. Bank card cost processors enjoy a crucial position in enabling corporations to remain ahead of the developments, giving the infrastructure needed to guide diverse payment methods.

Beyond the standard brick-and-mortar retail place, credit card payment processors are important in powering the great landscape of e-commerce. With the increase of online searching, processors help transactions in a virtual setting, managing the intricacies of card-not-present scenarios. The capacity to seamlessly steer the difficulties of electronic commerce underscores the adaptability and usefulness of charge card cost processors.

International commerce relies greatly on credit card payment processors to facilitate transactions across borders. These processors manage currency conversions, handle international compliance needs, and make sure that organizations may perform on an international scale. The interconnectedness of economic methods, reinforced by credit card payment processors, has developed commerce into a truly borderless endeavor.

Credit card payment processors contribute considerably to the development and sustainability of little businesses. By giving digital cost possibilities, these processors permit smaller enterprises to increase their customer bottom and contend on an even enjoying subject with larger counterparts. The supply and affordability of bank card cost processing companies have become critical enablers for entrepreneurial ventures.

The landscape of credit card payment control also requires concerns of fraud reduction and regulatory compliance. Payment processors implement strong procedures to identify and reduce fraudulent actions, guarding both firms and consumers. Also, keeping abreast of ever-evolving becoming a credit card processor needs assures that transactions abide by legitimate criteria, reinforcing the reliability and strength of the cost processing industry.

In conclusion, charge card cost processors type the backbone of contemporary financial transactions, facilitating the easy flow of resources between businesses and consumers. Their multifaceted role encompasses rate, safety, adaptability to scientific changes, and help for world wide commerce. As engineering remains to advance and client choices evolve, credit card payment processors can remain key to the active landscape of electric transactions, shaping the continuing future of commerce worldwide.…

Sales Acceleration: The Art of Selling Credit Card Machines

Selling charge card products requires navigating the vibrant landscape of financial engineering, knowledge the growing needs of companies, and providing alternatives that increase performance and client experience. As a seller, it’s important to position charge card products not merely as purchase tools but as built-in components of a modern, structured organization operation.

One of many key central details in selling charge card models is displaying the advantages they provide to businesses. These models permit protected and convenient transactions, accommodating a variety of cost practices from standard card swipes to contactless payments and processor inserts. Focusing the speed and stability of the transactions is essential, particularly in a world where customers assume seamless and quick cost processes.

In addition to transactional efficiency, dealers must underscore the protection characteristics stuck in contemporary bank card machines. With raising issues about data breaches and fraud, corporations are willing on adopting solutions that prioritize the safety of financial transactions. Credit card machines designed with encryption engineering and conformity with business requirements provide a protected atmosphere for both companies and their customers.

Knowledge the diverse wants of organizations is paramount in selling bank card machines. Different industries might require particular functions, such as for example supply administration integration, tip processing for restaurants, or recurring billing for membership services. Customizing alternatives based on the unique demands of every customer fosters trust and assures that the credit card device aligns seamlessly with their detailed processes.

More over, dealers require to stay informed about the most recent breakthroughs in bank card device technology. Including attention of emerging traits such as for example portable payment possibilities, digital wallets, and the integration of artificial intelligence in cost systems. Demonstrating a thorough knowledge of the ever-evolving fintech landscape instills assurance in customers, guaranteeing them that the answers provided are at the forefront of industry innovation.

Creating solid relationships with customers is a built-in part of successful credit card machine sales. This implies not just knowledge their immediate needs but also anticipating future requirements as their businesses grow. Establishing constant communication stations and providing receptive customer support contribute to an optimistic and enduring partnership.

Teaching clients concerning the cost-effectiveness of bank card machines is still another crucial part of the selling process. While there could be an initial expense, emphasizing the long-term savings from paid down money managing, minimized human problems, and improved transaction volumes can sway companies toward recognizing the worth of these products as proper assets rather than simple expenses.

Finally, vendors should consider giving extensive training and onboarding support to clients adopting bank card devices for initially or transitioning to improved systems. how to sell credit card machines assures a smooth integration method, decreases disruptions to everyday procedures, and maximizes the advantages of the new technology. Providing continuous training opportunities also roles sellers as valuable associates committed to the success of their clients.

In summary, selling bank card machines takes a multi-faceted approach that mixes technical experience, a heavy understanding of client wants, and powerful conversation skills. By placing credit card models as major methods that improve safety, effectiveness, and customer satisfaction, suppliers donate to the modernization and success of businesses across numerous industries.…