Recent Posts

- Lottery Payout Options: What’s the Best Choice for You?

- Short-Term Visa for Germany: Exploring the Country on a Temporary Basis

- Steroids and Autoimmune Diseases: The Immunomodulatory Properties of Performance-Enhancing Drugs

- Where Can I Purchase Elvanse 70 mg Without a Prescription?

- Skyline Shapers: The Innovative Journey of Vital Developers Limited

Recent Comments

Giga spin8 SLOT777 depo pulsa 5k TIMNAS4D royal77 autospin777 lentor mansion floor plan bola16 MPOPUSATLOGIN MENARA4D Local Viking range repair koitoto MENARA 4D rupiahtoto Bola16 Slot Gacor toto spin login pgsoft 10rb Bandar togel PAP4D padangtoto ingatbola88 Pussy888 Download rungkad bandar togel mahjong118 zeus slot slot zeus zeus slot Sabung Ayam Online liveslot365 liveslot365 mahjong ways 2 https://dewansengketa.id/wp-content/upgrade/app/config/ akun pro thailand اسم سایت های شرط بندی

สล็อตเว็บตรง

bagnall haus price MOLE4D KENANGAN4D SV388 MPO Slot sv388 autospin777 rtp live tradisibet the arcady at boon keng showflat MEGA888 bio88 slot situs mpo slot Servertogel Servertogel Slot Thailand slot thailand onic77 login slot thailand MOLE4D KENANGAN4D padangtoto BBNI4D rupiahtoto Jeparatoto padangtoto https://ekobintang.com/ totobet 22 BBTN4D hotel4d musik4d Topcer88 Topcer88 kenangan4d Cactus Labs iramatogel login PEWE4D BBNI4D Link Kingcobratoto Mailhosting slot online KKSLOT777 login dana69 Dana69 Angkanet slot Axa Claims Number sakura slot slot88 server thailand Kera4d slot gacor Auto Lautsprecher Systeme Slot link slot thailand livetotobet slot gacor hari ini bandungtoto slot server https://espacioiaunesco.org/ slot88 resmi Raja Slot link slot gacor situs online gacor GTA138 situs toto real estate franchise weichert Sultan88 Betwin188 slot88 deposit pulsa indosat 10rb pohon4d Crypto Trade Mastermind slot88 deposit pulsa tri 10rb slot gacor online nexus slot online

master togel car insurance online situs togel pokkawin situs togel bet 100 ug808 agen togel situs togel togelup bo togel slot gacor 88 kebaya4d situs togel Slot server Thailand Duta168 Slot Online Slot gacor https://www.infoselebriti.top https://www.selebterkini.live/ Doubledown Forum Yuk69 Koitoto168 slot dana topjitu login Server Thailand winslot slot gacor slot gacor Grinding Gear games blaze entrar

online cricket betting site slot gacor hari ini marketing1on1 pohon4d

เว็บสล็อตใหม่ล่าสุด keputusan GD Slot Gacor Hari Ini djarumtoto slot taktik88

weight loss steroids for sale 3milyartoto Djarumtoto slot demo pg http://www.tint21.com 3a娛樂城 haka4d mugiwaraslot

Slot Thailand 777

slot gacor hari ini

Slot Online

UGFREAK gta online

slot gacor

Slot Gacor

Djarumtoto slot gacor situs slot gacor Login Indobet

Superdrol for sale weight loss steroids for sale uk presidenttoto

situs slot

สล็อต

เว็บตรง

สล็อต

หวย

สล็อต

SLOT GACOR 4D

link slot gacor/ sultantoto situs slot thatslikewhoa jadwal slot toto slot INFINI88 mastertoto

situs toto slot

situs toto

INFINI88

สล็อต

สล็อต

娛樂城 SBOBET88 rtp slot88 judi bola slot nexus engine WIN88 SLOT88 ULTI234 situs slot terpercaya Slot Gacor slot gacor minimal deposit 5rb apidewa

สล็อต pg เว็บตรง แตกหนัก

เว็บสล็อต slot gacor judi slot 3milyartoto

線上真人娛樂

สล็อตเว็บตรงฝาก-ถอน true wallet ไม่มีขั้นต่ํา slot888 vip cambodia Daftar Indobet lapak303 situs judi sabung ayam online sv388

娛樂城推薦

สมัครสมาชิก สล็อตเว็บตรง

เว็บตรงสล็อต papuatoto สล็อต

娛樂城推薦

เว็บตรง

dewapoker poker88 https://pohon4d.site/ dewapoker poker88 slot pragmatic

Agentoto

slot gacor gratis maxwin88 zeus138 Rajacuan Gacor77

toto88

manadototo Slot depo gopay Data macau laris99

indobetpoker

Data macau

demo slot pragmatic

koin55

Data macau

togel online

auto7slot slot thailand daftar auto7slot agen sbobet judi online

Slot88 Terpercaya

sarana99 online138 Metrowin88 Kostenloser Porno

Slot Online Slot bonus new member https://decalstor.com/

merahtoto

talent management slot https://zerotrollerance.guru/ Demo slot metrowin88 Live Draw California sexy lingerie 訂花 slot online game slot online situs slot terbaru Situs slot gacor hari ini Slot Taiwan Slot Shopeepay BENTO 4D roulette casino slot gacor hari ini del-immune birutoto tungsten wedding bands rajacuan slot 먹튀폴리스 Freebet สล็อต rtp slot slot demo demo pg soft AKUN DEMO SLOT flavorz disposables buy targeted traffic https://mtpolizia.com/ 사나이 회원가입 https://dewatogel88.life/ matka slot88 Shibatoto Daman Games daman games Slot Demo unblocked games world カラコン Daman games login HealthPlanTotal slot online ZLD SYSTEM MANUFACTURER jdclub9.co/sg/en/evo888

777slot

slot777

slot gacor malam ini

slot pragmatic play

Cryptocurrency Systems and Software Optimum Blinds

Slot Online

http://nheri.re.kr/ jasa aspal murah LumBuy

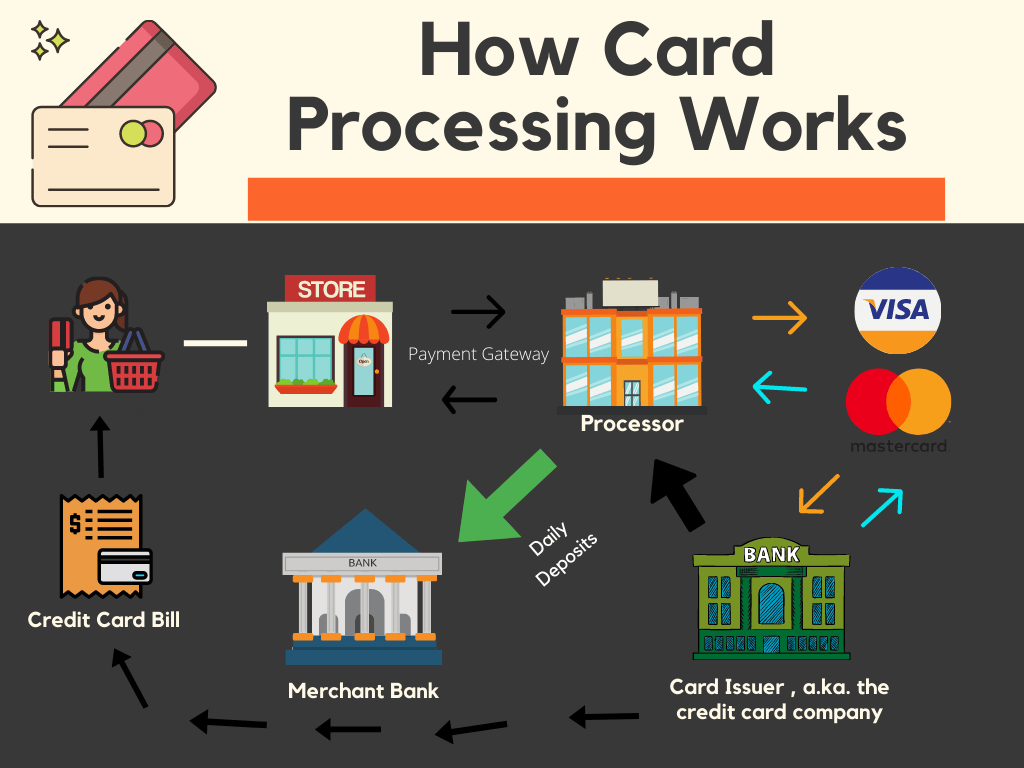

A charge card cost model plays a vital position in the modern financial landscape, providing while the linchpin that facilitates electric transactions between vendors and customers. These processors become intermediaries, joining organizations with the banking system and allowing the smooth transfer of funds. The essence of the function lies in translating the data from a bank card transaction right into a language clear by economic institutions, ensuring that obligations are approved, prepared, and settled efficiently.

One of the primary functions of a bank card cost model would be to boost the efficiency of transactions. Each time a client swipes, positions, or sinks their credit card, the cost processor quickly assesses the transaction facts, communicates with the relevant financial institutions, and validates whether the purchase may proceed. This method occurs in a subject of seconds, focusing the speed and real-time nature of credit card cost processing.

Security is a paramount issue in the region of financial transactions, and charge card cost processors have reached the forefront of applying actions to guard painful and sensitive information. Sophisticated encryption technologies and compliance with industry criteria make certain that customer knowledge stays protected through the entire payment process. These security steps not only safeguard people but also instill trust in firms adopting electronic payment methods.

The bank card cost running environment is continually developing, with processors adapting to technological breakthroughs and changing customer preferences. Portable funds, contactless transactions, and the integration of digital wallets symbolize the lead of advancement in that domain. Bank card cost processors enjoy a crucial position in enabling corporations to remain ahead of the developments, giving the infrastructure needed to guide diverse payment methods.

Beyond the standard brick-and-mortar retail place, credit card payment processors are important in powering the great landscape of e-commerce. With the increase of online searching, processors help transactions in a virtual setting, managing the intricacies of card-not-present scenarios. The capacity to seamlessly steer the difficulties of electronic commerce underscores the adaptability and usefulness of charge card cost processors.

International commerce relies greatly on credit card payment processors to facilitate transactions across borders. These processors manage currency conversions, handle international compliance needs, and make sure that organizations may perform on an international scale. The interconnectedness of economic methods, reinforced by credit card payment processors, has developed commerce into a truly borderless endeavor.

Credit card payment processors contribute considerably to the development and sustainability of little businesses. By giving digital cost possibilities, these processors permit smaller enterprises to increase their customer bottom and contend on an even enjoying subject with larger counterparts. The supply and affordability of bank card cost processing companies have become critical enablers for entrepreneurial ventures.

The landscape of credit card payment control also requires concerns of fraud reduction and regulatory compliance. Payment processors implement strong procedures to identify and reduce fraudulent actions, guarding both firms and consumers. Also, keeping abreast of ever-evolving becoming a credit card processor needs assures that transactions abide by legitimate criteria, reinforcing the reliability and strength of the cost processing industry.

In conclusion, charge card cost processors type the backbone of contemporary financial transactions, facilitating the easy flow of resources between businesses and consumers. Their multifaceted role encompasses rate, safety, adaptability to scientific changes, and help for world wide commerce. As engineering remains to advance and client choices evolve, credit card payment processors can remain key to the active landscape of electric transactions, shaping the continuing future of commerce worldwide.